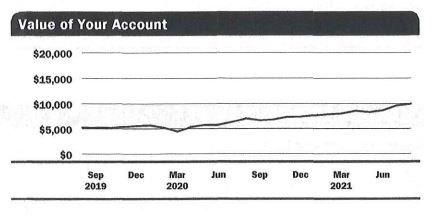

The LyncFund, a student-managed (Traditional and ABE students) investment fund of Lincoln College, is embedded in our BUS 301: Principles of Finance course and is designed to provide students with practical knowledge and experience in investing and finance. The student-run fund serves Lincoln College by managing a small portion of the College’s overall investment fund. The initial investment into this fund came from our Business faculty, members of our Board of Trustees, and members of our Administration at Lincoln College. The fund was created in 2019 with initial contributions of $4,500 and the current value of our portfolio is $9,400 (December 2021) and growing!

The LyncFund seeks to provide consistently high total return from a broadly diversified portfolio of equity securities with risk characteristics similar to the Standard and Poor’s 500 Composite Index (S&P 500 Index). The LyncFund provides students with the opportunity to gain experience and exposure to different types of securities while improving quantitative and qualitative research skills. Earnings distributions from the fund supports additional educational activities such as attending IACBE student competitions and the Engage Undergraduate Investment Conference, providing Business student scholarships, and bringing in professional speakers.

The LyncFund will be managed to maximize risk adjusted returns relative to the S&P 500 Index, using portfolio diversification techniques to minimize nonmarket risk. The LyncFund’s primary strategy for investment decisions is to find undervalued securities and hold those securities until their value is fully realized by the market. Student Analysts also monitor trends in macroeconomic factors such as interest rates, Federal Reserve policy, inflation, and the state of the overall economy. Additionally, risk management is critical and should be measured and controlled through proper monitoring of active exposures relative to the stated benchmark.

- The Fund seeks above-average returns by investing in securities that are determined, through analysis by student analysis teams, to be undervalued or poised for future growth. The analysis of the portfolio investments will be based on commonly accepted fundamental intrinsic valuation techniques, e.g., discounted cash flow models. Portfolio sales will be based on the same type of analyses.

- The portfolio will consist of publicly traded common stock investments, Exchange Traded Funds (ETFs) and bonds listed on the NYSE, AMEX, or NASDAQ.

- Portfolio stock purchases will be for cash; no margin trading will be permitted.

- Short positions and naked derivative trades are not permitted.

- Sector analysis is required as part of the fundamental stock analysis.

- No stock sector will comprise more that 20% of the portfolio and no individual stock position will comprise more than 10% of the entire portfolio.

- The target distribution for student programs and scholarships is 5% annually and will be generated from interest, dividends, and capital appreciation, also referred to as a total-return approach. Distributions would not normally be permitted unless the fund experiences positive returns over and above initial and subsequent contributions. The Division Chair of the MacKinnon School of Business in consultation with the LyncFund Advisory Board will prioritize the distribution of funds based on need of student programs and scholarships.

Students in our BUS 301: Principles of Finance course submit portfolio recommendations for the LyncFund and these recommendations are submitted to the LyncFund Advisory Board for consideration each semester. Our LyncFund assets are managed by Edward Jones Financial Advisors and only authorized Advisory Board members may authorize purchases and/or sales of our portfolio assets.

For more information on our LyncFund, please contact Mr. Aaron Hurley at [email protected].

If you are interested in making a tax-deductible contribution to the Lincoln College LyncFund, please send your donation to:

Lincoln College

C/O LyncFund Business Office

300 Keokuk Street

Lincoln, IL 62656